nevada estate tax rate

The Property Tax Statement is mailed around the middle of July each year. 195 for each 500 of value or fraction thereof if the value is over 100.

Nevada Is The 9 State With The Lowest Property Taxes Stacker

Each states tax code is a multifaceted system with many moving parts and Nevada is no exception.

. Tax bills requested through the automated system are sent to the mailing address on record. Typically the taxes are received under one assessment from the county. These rates are then applied to the assessed values set by the Carson City Assessor as of June 30 of each year.

Property Tax Rates Linda Jacobs Washoe County Treasurer. If real property is purchased during the fiscal year or if a mortgage company is no longer responsible for making tax payments call our office to request a bill at 702-455-4323. Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

We dont make judgments or prescribe specific policies. No estate tax or inheritance tax. Taxing authorities include Reno county governments and many special districts such as public schools.

There are three vital steps in taxing property ie setting tax rates estimating property market values and receiving receipts. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value. Every municipality then receives the tax it levied.

No estate tax or inheritance tax. As a result the average combined state and local sales tax rate is 8. Under state law the government of Gardnerville public hospitals and thousands of.

The property tax rate for Carson City is set each year around the end of June. No estate tax or. 10 is added.

Assessed value X tax rate property taxes due. The top estate tax rate is 16 percent exemption threshold. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes.

States levy property tax based on the value of your property. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax Credit Nevada that was collected prior to January 1 2005.

No estate tax or inheritance tax. Nevadas tax system ranks 7th overall on our 2022 State Business Tax Climate Index. Nevada has a 685 percent state sales tax rate a max local sales tax rate of 153 percent and an average combined state and local sales tax rate of 823 percent.

Please verify your mailing address is correct prior to requesting a bill. NRS 3614723 provides a partial abatement of taxes. The amount of taxes payable annually on a property is calculated by multiplying the assessed amount by the tax rates established by the taxing authorities that provide public services.

Tax Rate 32782 per hundred dollars. Meaning a homeowner wont ever see an increase in property tax of more than three percent. Carson City NV 201 N.

The median property tax in Nevada is 174900 per year for a home worth the median value of 20760000. There are no estate or inheritance taxes in the state either. The Declaration of Value is a form prescribed by the Nevada Tax Commission to provide information with regard to the transfer of real property.

Calculating Tax Relief With the Provisions of AB489 Tax Relief NRS 3614723 During the 2005 session of the legislature a tax relief package was passed that caps property tax increases as. Sales tax is one area where Nevada could do better. Ninth Street Reno NV 89512.

The state imposes a 685 tax and counties may tack on up to. The states average effective property tax rate is just 053 which is well below the national average of 107. Carson Street Carson City NV 89701.

Compared to the 107 national average that rate is quite low. Homeowners in Nevada are protected from steep increases in property tax bills by Nevadas property tax abatement law which limits annual increases in property tax bills to a maximum of 3 for homeowners. Counties in Nevada collect an average of 084 of a propertys assesed fair market value as property tax per year.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. The County Assessor establishes the value of all property for tax purposes. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

All are official governing entities managed by elected or appointed officers. In California the average home price is 668300. The state imposes a 685 tax and counties may tack on up to 153 more.

Tax District 200. See what makes us different. Are property taxes higher in Nevada or California.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. This is after budget hearings and review by the State Department of Taxation. Overall there are three phases to real property taxation.

However thats only if the. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues. But Nevada does have a relatively high sales tax a state rate is around 7 but goes to approximately 8 when you consider local tax rates.

The states average effective property tax rate is just 053. Right now the tax cap in our state is at three percent for a primary home. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

So even though Nevada does not have an estate tax gift tax or inheritance tax it does not mean that she won. 5740 million North Carolina. Assessment Ratio 35.

For more information contact the Department at 775-684-2000. Nevada is ranked number twenty four out of the fifty states in order of the average amount of property taxes collected. Nevadas property tax rates are among the lowest in the US.

Establishing tax levies estimating property worth and then bringing in the tax. 60 is added. Total Taxable value of a new home 200000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes In Nevada U S Legal It Group

City Of Reno Property Tax City Of Reno

Taxes In Nevada U S Legal It Group

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Nevada Inheritance Laws What You Should Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Vs California Taxes Explained Retirebetternow Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Nevada Property Tax Calculator Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

Nevada Tax Rates Rankings Nevada State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nevada Tax Advantages Luxury Real Estate Advisors

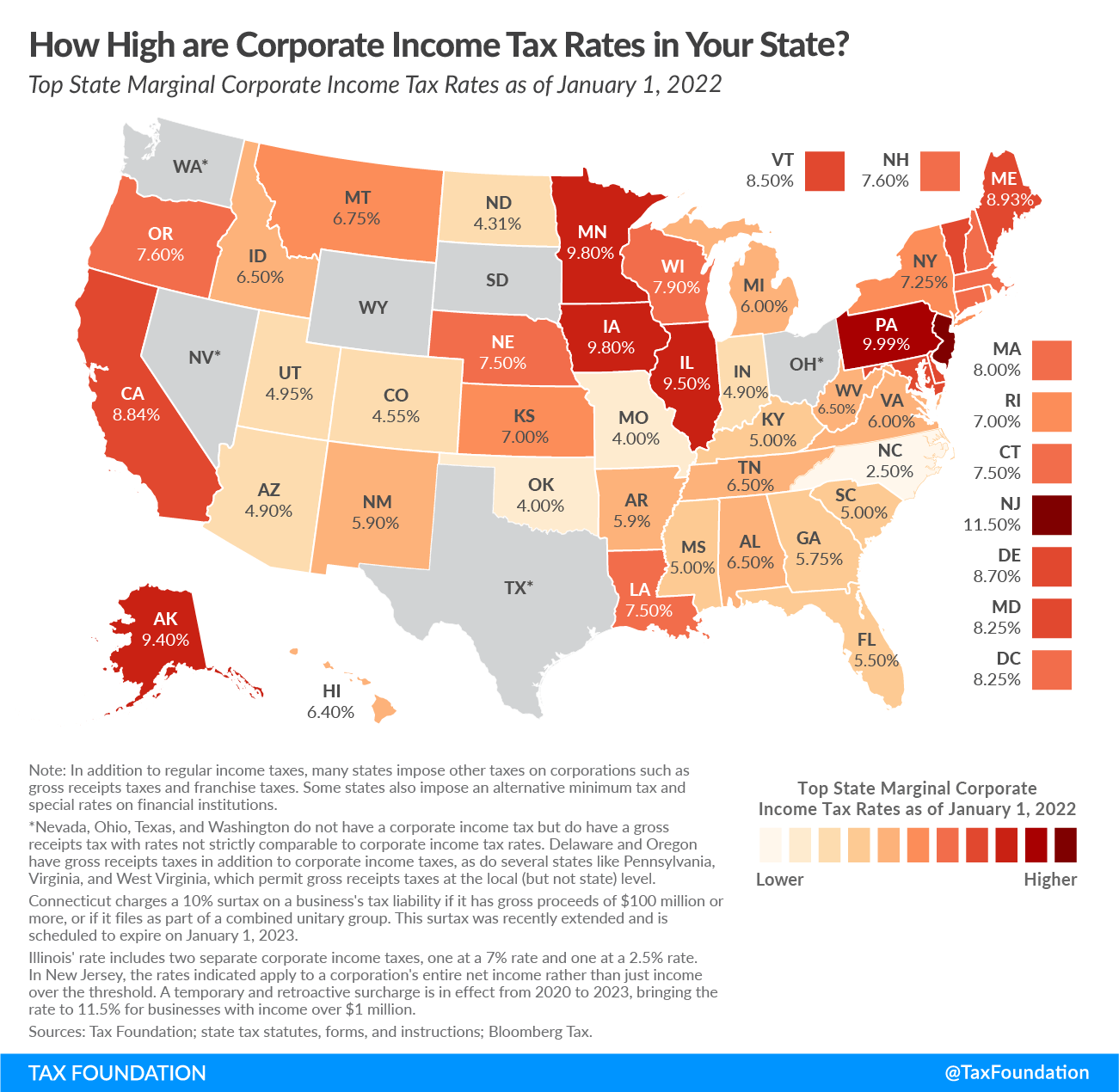

State Corporate Income Tax Rates And Brackets Tax Foundation